santa clara property tax rate

If you are unable to pay your property taxes the county can sell your home to collect all unpaid property taxes. Currently you may research and print assessment information for individual parcels free of charge.

Property Taxes Department Of Tax And Collections County Of Santa Clara

It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction.

. County of Santa Clara. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. On your tax bill you will see 1 Maximum Levy listed with the other individually identified charges for voter-approved debt.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value. Every entity establishes its individual tax rate. Every year your county collects state and local taxes based on the value of your home or land property.

Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. GASB 44 Economic Condition Reporting 10-year data Property TaxValuation related Changes in Net Position Changes in Fund Balances of Governmental Funds General Governmental Tax Revenues by Source Taxable Assessed Value of Property Property Tax Rate. Santa Clara charges property taxes annually.

Tax Rate Book Archive. Enter Property Parcel Number APN. Property Assessment With such a low tax rate it would be fair to assume that average property tax bills would remain low.

In Santa Clara Countys case the tax rate equates to 073 which is very low compared to the US. Tax Rates for Santa Clara CA. Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax.

Whether you are already a resident or just considering moving to Santa Clara to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The first installment is due and payable on November 1. FY2019-20 PDF 198 MB.

FY2020-21 PDF 150 MB. However you have until 5 pm. Learn all about Santa Clara real estate tax.

Property Taxes - CAFR Statistical Section. Compilation of Tax Rates and Information. Some parts of Santa Clara County San Jose Palo Alto and Mountain View specifically also impose an additional city conveyance tax of 165 per every 500.

For example if there is voter approved bond indebtedness of 025 the tax rate on the parcel would be 125 or 125 for each hundred dollars of assessed valuation of the parcel. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. 930 The total of all income taxes for an area including state county and local taxes.

Property Tax Rate Book Property Tax Rate Book. Each county has a specific deadline for unpaid taxes before they start the process. The secured property tax bill is payable in two installments.

825 The total of all sales taxes for an area including state county and local taxes Income Taxes. For Santa Clara County the rate is 055 per every 500 although that excludes any liens or encumbrances. When are Secured Property Taxes due in Santa Clara County.

By law the tax rate is limited to 1 of the assessed value plus amounts required for the payment of principal and interest on voter approved bond indebtedness. Currently you may research and print assessment information for individual parcels free of charge. Home Page Browse Video Tutorial Developers.

Skip to Main Content Search Search. On December 10 to make your payment before a 10 penalty and 2000 cost is added to your bill. The budgettax rate-setting process typically involves regular public hearings to debate tax issues and related budgetary considerations.

The median property tax on a 70100000 house is 469670 in Santa Clara County The median property tax on a 70100000 house is 518740 in California The median property tax on a 70100000 house is 736050 in the United States. PROPERTY ASSESSMENT INFORMATION SYSTEM. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

Pin On Articles On Politics Religion

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Why Buy Now Lennar House Styles New Homes

Ownership Interests Fee Simple Improve Condominium

12335 Stonebrook Dr Los Altos Hills Ca 94022 Zillow Los Altos Hills Mansions Secret Rooms

Investors Pile Into Housing This Time As Landlords Being A Landlord Investors Home Switch

Santa Clara County Ca Property Tax Calculator Smartasset

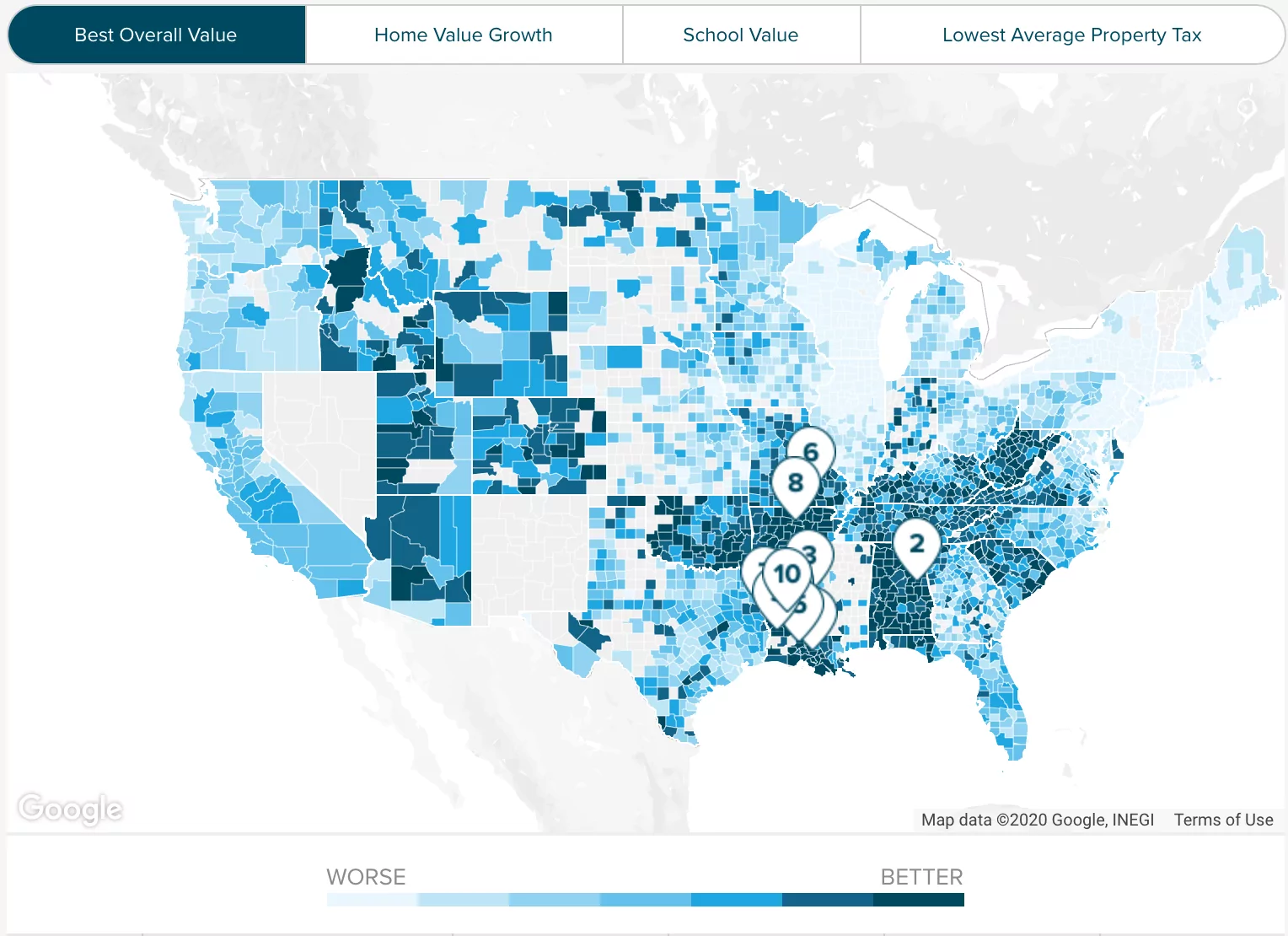

Top 10 Counties With Equity Rich Properties Equity San Mateo County County

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Nacons Builders Has Designed A Number Of The Best Properties In Bangalore That Include Luxury Flats Pr Independent House House Styles Real Estate

Luxury Residential Flat Projects In Pune Ekta California Residential Residential Apartments New Construction

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Vacation Rental Market Analysis St George Ut Vacation Rental St George Vacation

Mortgage Broker Agreement Mortgage Brokers Proposal Templates Legal Forms